vermont income tax refund

A nonresident of Vermont for services performed in. The state of Vermont is one of the few states in which the state itself levies a property tax in addition to those the local government does.

State Income Tax Rates Highest Lowest 2021 Changes

South Carolina Tax Brackets 2022 - 2023.

. Payments subject to Vermont tax withholding include wages pensions and annuities. Processing Time and Refund Information. Other payments are generally subject to Vermont income tax withholding if the payments are subject to federal tax withholding and the payments are made to.

North Carolinas maximum marginal income tax rate is the 1st highest in the United States ranking directly below North Carolinas. Looking at the tax rate and tax brackets shown in the tables above for South Carolina we can see that South Carolina collects individual income taxes similarly for Single versus Married filing statuses for example. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 202223 tax refund.

PA-1 Special Power of Attorney. Loans are offered in amounts of 250 500 750 1250 or 3500. W-4VT Employees Withholding Allowance.

B-2 Notice of Change. Fact Sheets and Guides. Form 740 is the Kentucky income tax return for use by all taxpayers.

During the Income Tax Course should HR Block learn of any students employment. The Income Tax School invests significantly to ensure the very best curriculum development and content delivery. A Vermont resident or.

Property taxes in Vermont are among the highest in the nation but sales taxes are below average. This PDF packet includes Form 740 supplemental schedules and tax instructions combined in one document updated for the 2011 tax year. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Unlike the Federal Income Tax North Carolinas state income tax does not provide couples filing jointly with expanded income tax brackets. Overview of Vermont Retirement Tax Friendliness. Form 740 - Individual Income Tax Return.

This form may be used by both individuals and corporations requesting an income tax refund. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. All Forms and Instructions.

The states education tax supports schools as do local school district taxes in most other states and is. We would like to show you a description here but the site wont allow us. Alabama income tax forms are generally published at the end.

Please reference the Alabama tax forms and instructions booklet published by the Alabama Department of Revenue to determine if you owe state income tax or are due a state income tax refund. Vermont Income Tax Withholding. North Carolina collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

This is an optional tax refund-related loan from MetaBank NA. This calculator is for 2022 Tax Returns due in 2023. Burgess former IRS Deputy Asst.

Commissioner and District. Looking for a quick snapshot tax illustration and example of how to calculate your. This includes Social Security retirement benefits and income from most retirement accounts.

Vermont taxes most forms of retirement income at rates ranging from 335 to 875. 2022 Alabama State Tax Rate Schedule published by the Alabama Department of Revenue. IN-111 Vermont Income Tax Return.

202223 Tax Refund Calculator. It is not your tax refund. Feedback from participants has been excellent and truly supports The Income Tax Schools position that it sets the standard for tax preparer training Roger K.

Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022. We can also see the progressive nature of South Carolina state income tax rates from the lowest SC tax rate.

Where S My State Refund Track Your Refund In Every State

State Corporate Income Tax Rates And Brackets Tax Foundation

Education Tax Credits And Deductions Can You Claim It Tax Credits Educational Infographic Education

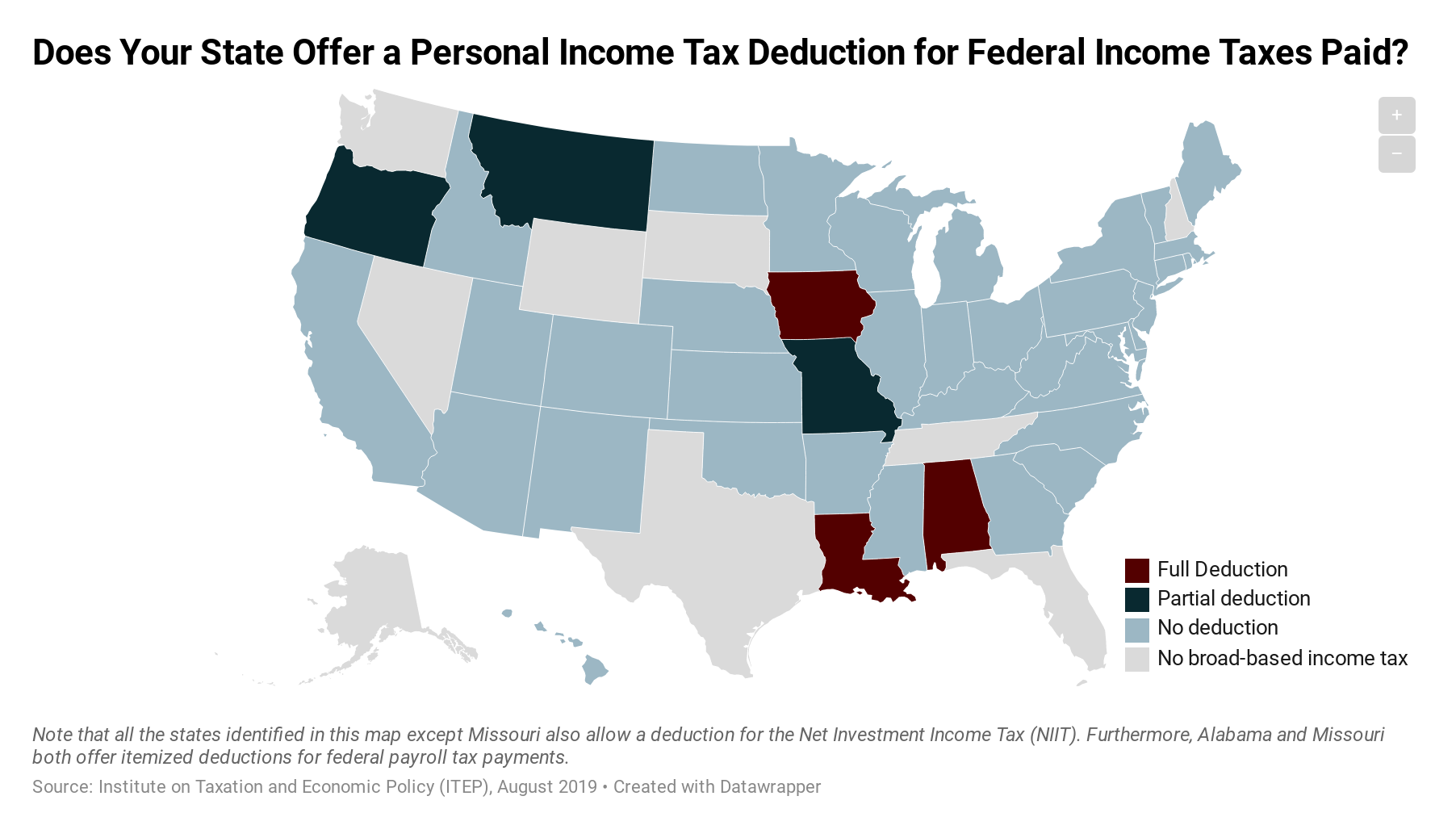

Which States Allow Deductions For Federal Income Taxes Paid Itep

Tax Credit Tax Credits Tax Help Tax

Jansport Virginia Tech Shirt Tech Shirt Jansport Shirts

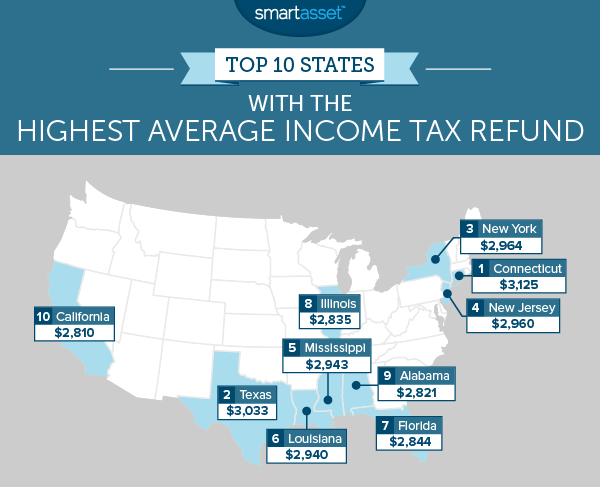

The Average Tax Refund In Every State Smartasset

The Most And Least Tax Friendly Us States

The Average Tax Refund In Every State Smartasset

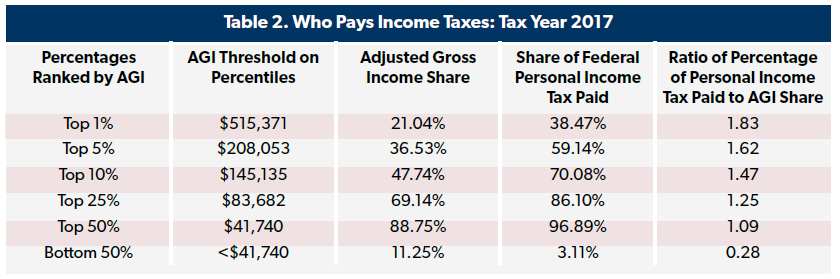

Who Pays Income Taxes Tax Year 2018 Foundation National Taxpayers Union

Irs Owes Taxpayers More Than 1 Billion In Unclaimed Tax Refunds Tax Refund Income Tax Return Irs

Personal Income Tax Department Of Taxes

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Tax Prep Tax Preparation Income Tax Preparation

How Is Tax Liability Calculated Common Tax Questions Answered

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation