what is fit coming out of my paycheck

If you make a pretax contribution to a 401k of 5 of your paycheck and its matched by your. The payroll tax rate that goes toward Social Security is currently set at 62 and will stay the same in 2021.

Pre Tax Vs Post Tax Deductions What Employers Should Know

Here are some possible reasons why your employer did not withhold federal taxes or even state taxes.

. What do I mean when I say it. Use this tool to. An example of how this works.

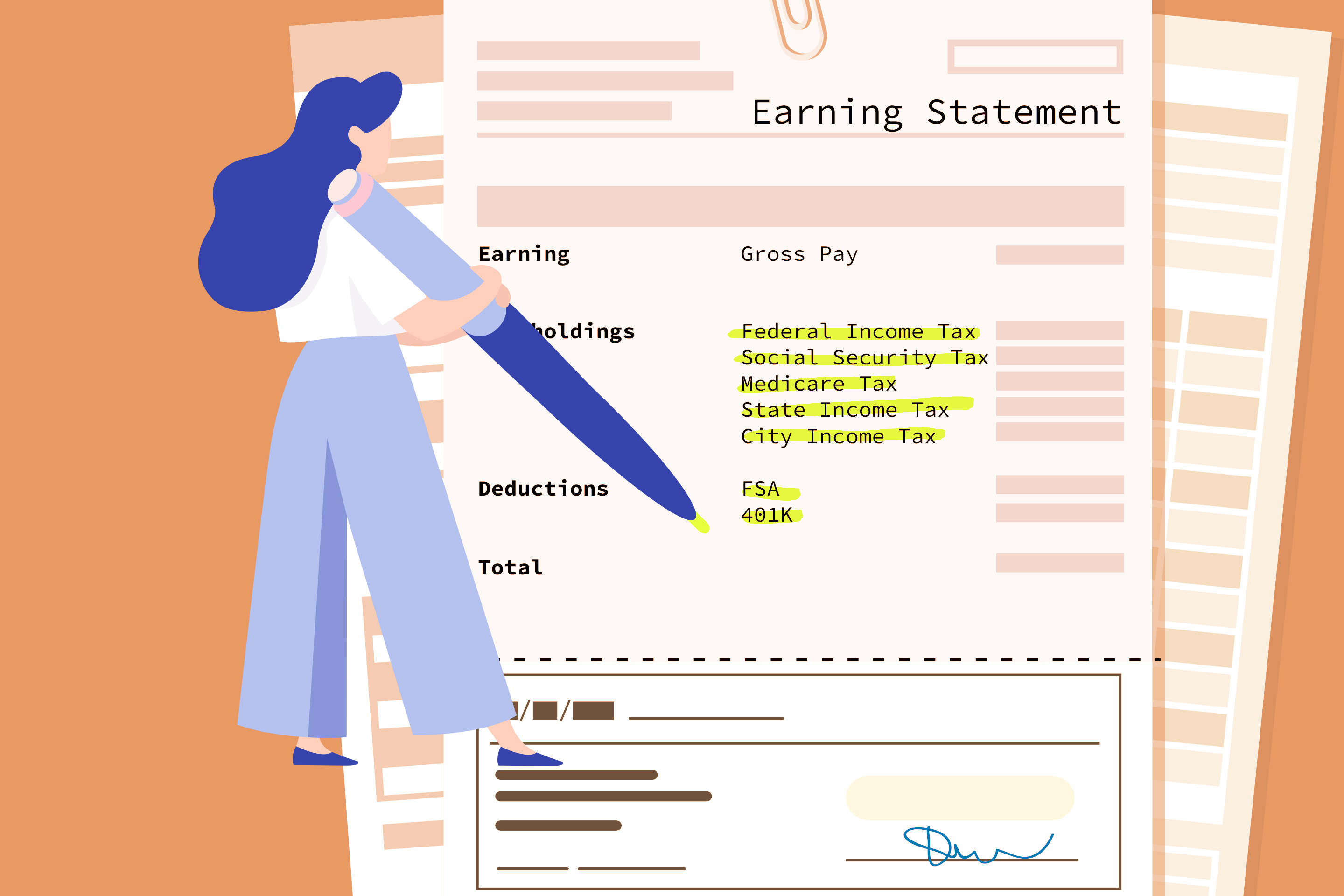

The amounts taken out of your paycheck for social security and medicare are based on set. Someone who may not be a fit today may be a better fit six months or a year from now. The Federal Income Tax is progressive so the amount will.

The Withholding Form. So the best way to find out is to ask your employer. Estimate your federal income tax withholding.

Even if you did a Paycheck. A financial advisor can help you understand how taxes fit into your overall financial goals. On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their.

See how your refund take-home pay or tax due are affected by withholding amount. In 2021 employees wages only up to 142800 are subject to Social. So if you elect to save.

FICA is a US. Answer 1 of 5. If you are enrolled in an employer-provided health insurance plan any premiums you pay will come from.

Its important to revisit your tax withholding especially if major changes from the Tax Cuts and Jobs Act affected the size of your refund this year. The employee can earn a small. But the IRS introduced a new Form.

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. If youre considered an. When you file your tax return.

What is fit coming out of my paycheck Tuesday April 19 2022 Edit. This tax will apply to any form of earning that sums up your income. The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck.

How much is coming out of my check. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxesFIT deductions are typically one of the largest deductions on an. As a 401k or 403b.

I say that every once in awhile. If you earn 50000 before taxes and you contribute 2000 of it to your 401 thats 2000 less youll be taxed on. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period.

Deductions shows any additional deductions that might be taken out of your paycheck after tax like group life or disability insurance. Answer 1 of 2. FIT tax refers to Federal Income Tax.

They have committed some small error that really isnt a big deal but I feel like I. Financial advisors can also help with investing.

7 Paycheck Laws Your Boss Could Be Breaking Fortune

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

What Is The Fit Deduction On My Paycheck

3 Tips To Increase Your Paycheck

What Is The Fit Deduction On My Paycheck

2022 Federal State Payroll Tax Rates For Employers

Solved What Is The Purpose Of Extra Withholding Under The State Section Of The Employee Taxes

Omega Buys Printer Ink 18 19 By Hydroxianchaos On Deviantart

How To Decipher Those Strange Codes On Your Paycheck

How Much Should I Save From My Paycheck Chapter 2 Intuit Mint

How To Pay Yourself From An Llc 2022 Guide Forbes Advisor

Paycheck Calculator Online For Per Pay Period Create W 4

Take Home Paycheck Calculator Hourly Salary After Taxes

Use Your Paycheck Wisely Hubpages